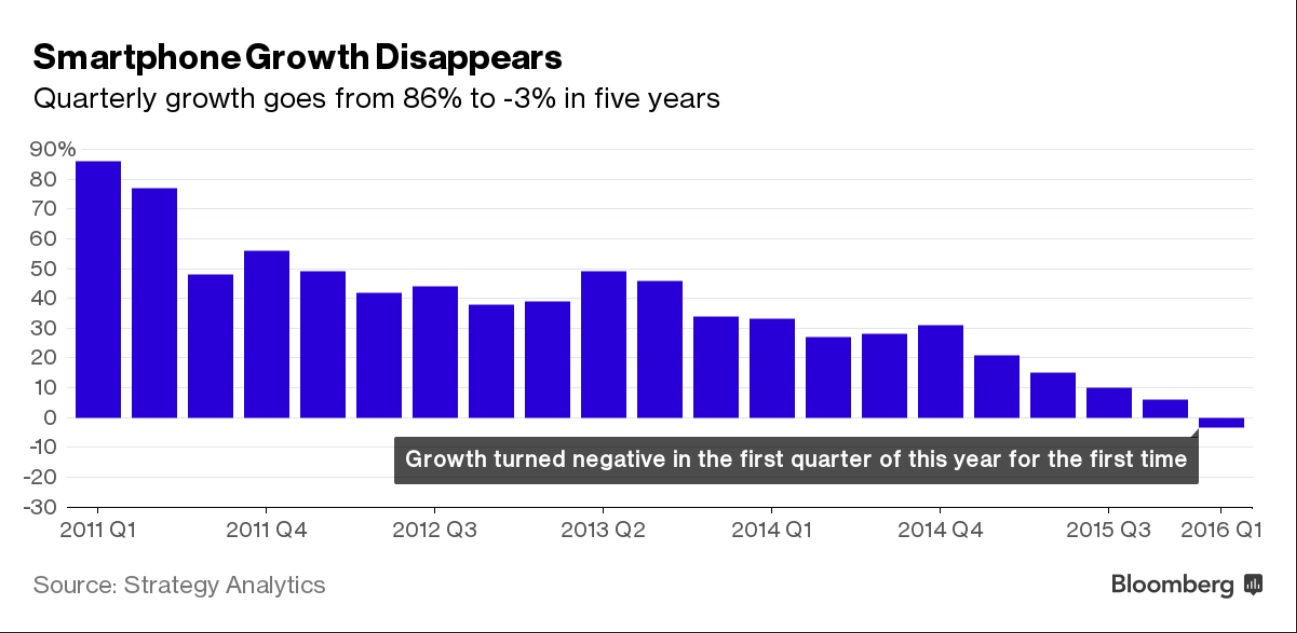

Bloomberg has shared an extensive analysis of the end of the smartphone growth era. Under the headline “Are Smartphones Doomed to the Same Fate as Personal Computers?”, the study warns that, “with consumers upgrading smartphones less often and first-time buyers harder to find, handset makers seem doomed to endure the same years-long sales decline as PC manufacturers. The industry has yet to identify and market the next big idea to take the place of smartphones.” But is this going to affect our future options for e-reading, or the functions on our ebook gadgets?

Bloomberg has shared an extensive analysis of the end of the smartphone growth era. Under the headline “Are Smartphones Doomed to the Same Fate as Personal Computers?”, the study warns that, “with consumers upgrading smartphones less often and first-time buyers harder to find, handset makers seem doomed to endure the same years-long sales decline as PC manufacturers. The industry has yet to identify and market the next big idea to take the place of smartphones.” But is this going to affect our future options for e-reading, or the functions on our ebook gadgets?

Bear in mind that this article is taking a business and financial angle, looking for fresh growth catalysts. As with the PC market, it does not mean that smartphones are going to disappear overnight. It does mean, though, that “after almost a decade of turbocharged sales, the $423 billion industry can no longer count on consumers to robotically upgrade their handsets, putting at risk the fat margins and steady revenue growth long envied by the rest of the hardware sector.”

At least one analyst puts this down to Apple and the iPhone. “The end of the Apple super cycle is upon us,” says Neil Campling, an analyst at Aviate Global LLP, as quoted by Bloomberg. And the failure of Apple’s latest wheeze to goose its iPhone sales – importing second-hand handsets into India – suggests how little Apple can rely on its former reservoirs of demand.

Should ebook fans worry? I’d suggest not – and I’d also predict that the biggest winner out of this whole market readjustment could be Amazon, with Google as a possible second. Bloomberg quotes another analyst, Neil Mawston of Strategy Analytics, on the bases that hardware manufacturers need to cover now to tap tech-driven growth: “the Internet of Things, drones, consumer robots, wearables, smart homes, cars and offices.” Mawston predicts that “that cocktail is the next big wave beyond phones, rather than one big new segment.”

Now, what company can you think of that’s hitting most of those targets? Amazon, surely. From its drone delivery operations to Amazon Dash Buttons, from Alexa to the Kindle Oasis, Amazon seems to be finding both new hardware applications, and faithful consumers who will actually pay to upgrade their devices to a newer, swankier model. Not to mention the success of the $50 Fire, which uses smartphone-style tech to deliver a bottom-dollar shop window for Amazon’s Kindle Store and media offerings.

And there’s the flaw in Bloomberg’s analysis. By focusing exclusively on hardware, it’s missing the point about how many of these devices are simply portals to software/online ecosystems. Apple has skewed perceptions of this model because it locked its ecosystem into its hardware, but no other smartphone or device maker takes that approach. Google, or Amazon, can profit from every kind of device that hooks up to their platforms, whether it’s Dash Buttons or dirt-cheap Android e-readers, Echo speakers or no-brand China-made tablets. So even while smartphone makers feel the pain – and investors cast around for fresh ideas to batten on – our options for e-reading and digital content access are likely to continue to grow broader and more diverse, and user-friendly.