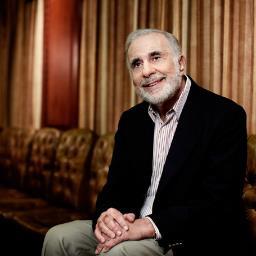

Activist investor Carl Icahn has put Apple fairly in his sights with a tweet and subsequent interviews that confirmed he has taken up a large position in the Cupertino giant’s stock – in the expectation of pushing it into escalating its share buyback program, which would deliver a handsome return to shareholders.

“Having purchased $500 million more

“Having purchased $500 million more $AAPL shares in the last two weeks, our investment has crossed the $3 billion mark yesterday,” he tweeted, following this with: “We feel $APPL board is doing great disservice to shareholders by not having markedly increased its buyback. In-depth letter to follow soon.”

As quoted on CNBC, Icahn said: “Cash of a $150 billion just sitting there doing nothing. And not to use it to do a huge buyback, is sort of disgraceful.” He also disclosed a new $500 million investment into Apple stock, bringing his total commitment to some $3 billion. And he has little reason to regret that commitment so far – Apple shares have risen some 17 percent, according to Reuters, and the company is already in the middle of a share buyback program worth $60 billion, part of a total $100 billion package of measures to return cash to investors.

Icahn has pushed for a total $150 billion package for investors, in a proposal which Apple has advised its shareholders to reject. And one main reason cited was that Apple needs a large cash pile on hand to protect its position and exploit new opportunities rapidly in a fast-changing mobile communications market.

That leaves open the question of whether Apple is actually doing that. Icahn has said that he has no issue with current Apple management strategy outside the area of returns to investors. But falling profits in the autumn 2013 reporting season suggested that Apple was very much in need of the next game-changing technology or product that analysts at the time called for. And other reporting at the beginning of this year suggests that Apple is also facing erosion of market share from Android and other competitors, even after the release of new iPhones like the 5s and 5c.

Icahn may very well be right to ask some of that cash pool to be returned to investors. He could also ask what it’s there for in the first place if these are the results. Perhaps it really is, as he says, sitting there and doing nothing – certainly looks like it ought to be doing something. Watch this space.

Apple needs to hold onto it to pay the huge fines it’s going to be smacked with for its anti-trust violations. 🙂

Most of that cash is overseas and re-patriating it will incur great (tax) cost. Ichan knows all this, of course. There’s more to this than meets the eye.

LOL, Icahn is such a poser – very transparent. But his money is doing the talking and he’s throwing a whole helluva lot at Apple.

And yeah, Chris, Apple will probably be fined $1 trillion for its ebook sins and Amazon will finally make a profit when Cote and Bromwich pass it back as compensation (less Bromwich’s 15% management fee of course).

Mike, this reminds me of the brainwashing scene in Zoolander: “Amazon: BAD. Apple: GOOD”

The guy owns $3b of stock. Here’s to hoping there is a big enough temporary dip in the price so he loses his daughter’s wedding $$.

And when it comes to profits, “Amazon: BAD. Apple: GOOD” is an understatement, unless of course we take into account Chris’ hocus pocus Amazon business model.