European consulting firm, IDATE, has released its 130 page study of the ebook market for Japan, America and Europe for 2008-2015. The report costs between 2,900 and 3,500 euros, but they have allowed me to release part of their principle results (blockquotes omitted):

By the end of 2010, the digital book market took off in all of the surveyed countries,

albeit under varying scenarios. That year, the United States became the world’s largest

market with a turnover from e-book sales reaching EUR 594 million, ahead of Japan, e-

book pioneer country whose market is evaluated at EUR 527 million. European markets

remain relatively modest, but are characterised by strong growth rates (around 80%).

This digital migration concerns all literary genres, although some more rapidly than

others (sentimental literature, science fiction & fantasy, detective stories) and a wide

range of media (e-readers, PCs, mobile phones, game consoles, tablets, media players).

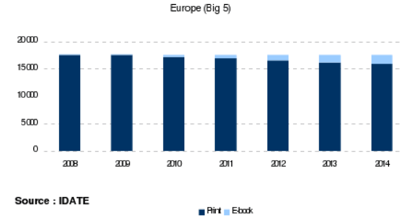

• By 2014, the digital transition should not result in a global loss (or destruction) of book

value. Certainly, sales of printed books have been declining for several years in the

surveyed countries (except for France and Canada), and the emergence of a digital offer

will only accentuate this trend, especially for the literary genres that are prone to this

digital migration. However, e-book sales should offset the decline in printed book sales,

and potentially even expand the book market thanks to the incremental sales effect (i.e.,

digital book sales which would not have taken place with printed books). By 2015, the

future of the market will be shaped by factors operating at two levels: the degree of

conversion of casual readers to digital media (who represent the bulk of the book market

in terms of volume) and the impact of enriched books, hybrid multimedia products

capable of attracting people who are not regular consumers of traditional books.

• The digital book market is at present indeed largely a transposition of the printed book

market. Firstly, digital catalogues consist mostly of homothetic books, while enriched

books and genuine digital creations remain anecdotal. Secondly, e-book readers are

mostly the same as printed book readers, and they tend to purchase the same titles. In

addition, current e-book pricing policies reproduce the dominant model of the printed

book market (individual downloads in North America and Europe and subscriptions to

episode series in Japan). The other models (rental, chapter-by-chapter sales,

advertisement) are limited to specific genres. Finally, apart from taxation, the regulatory

framework (including regulations on the single price of books) is increasingly similar

across the different countries.

• The new value chain is characterised by changing power relationships. At the top,

publishers are reaffirming their value to authors and agents tempted to bypass them. At

the bottom, they fuel the book supply, orchestrate their distribution and influence the final

sales price. For retailers, the intensity of competition increases as a result of the

multiplication of intermediaries (traditional booksellers, pure players, aggregators,

equipment suppliers, Internet giants, mobile operators). Globally, competition is

developing around major players ready to break the established rules, such as Amazon,

which relies on the most developed premium offer with aggressive pricing policies,

Apple, which is developing more restricted but more localised offers on its iBooks

application (which is promoting the agency model), and soon Google Editions (a.k.a.

Google eBooks), which leverages its Google Books digitisation programme and its

powerful search algorithms (enabling text searches across its entire book collection).