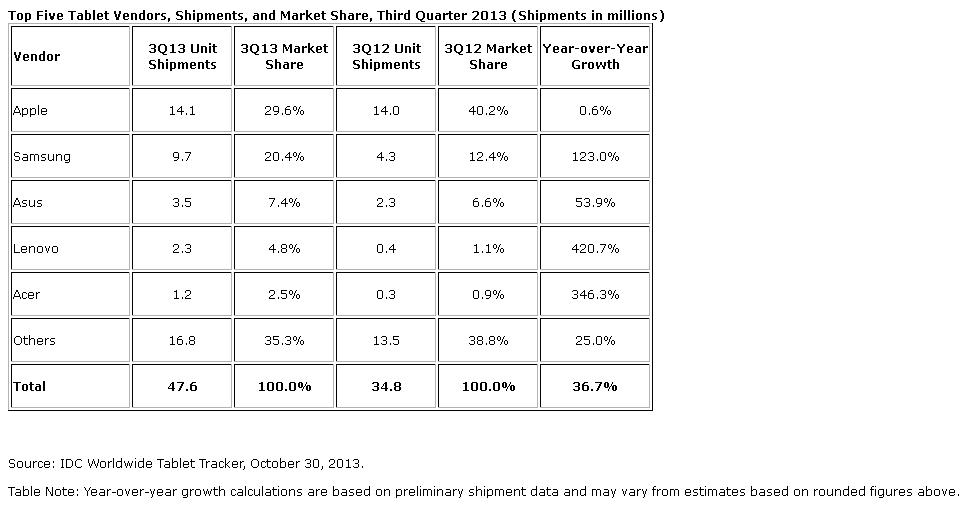

Adding to the slew of quarterly market data, the latest issue of International Data Corporation (IDC)’s Worldwide Quarterly Tablet Tracker showed worldwide tablet shipments up 36.7 percent on the same time last year and 7 percent on the previous quarter. And, notes IDC, “Android products once again drove much of the shipment growth in the market as iOS growth stalled and Windows tablets continued to struggle to win over consumers. With no new iPad product launches in the second or third quarter to drive volume, Apple experienced a quarter-over-quarter decline in shipments from 14.6 million in 2Q13 to 14.1 million in 3Q13. Year over year, iPad shipments grew less than one percent.”

IDC attributes the fall in iPad numbers partly to Apple’s “decision in late 2012 to move its product launches from earlier in the year to the fourth quarter,” leading to a market share slide to its lowest figure ever of 29.6 percent. The new iPad Retina mini and iPad Air, both due to ship in the fourth quarter, should see a strong bounceback, though, IDC opines.

IDC attributes the fall in iPad numbers partly to Apple’s “decision in late 2012 to move its product launches from earlier in the year to the fourth quarter,” leading to a market share slide to its lowest figure ever of 29.6 percent. The new iPad Retina mini and iPad Air, both due to ship in the fourth quarter, should see a strong bounceback, though, IDC opines.

“Apple is taking steps to appeal to multiple segments,” notes Jitesh Ubrani, Research Analyst with IDC’s Tablet Tracker, of Apple’s new pricing strategy. However, current prices still typify “Apple’s ongoing strategy to maintain its premium status.”

Overall, that may be the smart way to go, while Apple remains its walled garden/proprietary platform approach. Steve Jobs’s threatened “thermonuclear war” against Android clearly hasn’t broken out – or if it has, Apple is losing it. With the no-brand OEM Android tablet manufacturers pushing devices into practically every supermarket checkout aisle and stationer, it’s clear that a race to the bottom is on which Apple is unlikely ever to win.

“White box tablet shipments continue to constitute a fairly large percentage of the Android devices shipped into the market,” said Tom Mainelli, Research Director, Tablets at IDC. “These low cost Android-based products make tablets available to a wider market of consumers.” He then warns of lower-quality user experience and resulting customer disloyalty, cautioning that: “shipments alone won’t guarantee long-term success. For that you need a sustainable hardware business model, a healthy ecosystem for developers, and happy end users.”

The question is whether that argument would ever be enough to encourage customers to jump ship en masse to Apple. Judging from its pricing strategy, the Cupertino Core has obviously concluded that they won’t. They do, however, seem quite able to distinguish good, great, and mediocre in the Android ecosystem, and reward quality accordingly. Samsung, whose build and design quality arguably sometimes surpass Apple, has been rewarded once again with second largest share of the global tablet market at 20.4 percent, according to IDC.