I am going to do two things in this rebuttal. First, I would like to thank this site’s -ireadereview.com- authors for their tireless efforts at bringing us great pieces; second, I am going to state quite clearly that I vehemently disagree with this author’s core argument regarding the long term unsustainable nature of $9.99 and under pricing. I have seen pieces from Newsweek to the New York Times that clearly highlight that a $9.99 e-book has close to the same profit spread of a $26 hardcover.

I am going to do two things in this rebuttal. First, I would like to thank this site’s -ireadereview.com- authors for their tireless efforts at bringing us great pieces; second, I am going to state quite clearly that I vehemently disagree with this author’s core argument regarding the long term unsustainable nature of $9.99 and under pricing. I have seen pieces from Newsweek to the New York Times that clearly highlight that a $9.99 e-book has close to the same profit spread of a $26 hardcover.

At first the assumption may seem counter intuitive until one realizes that in publishing there exist two devilish things. The first concern being the uncertain nature of demand coupled with the wicked price elasticity of books. “How many books will we sell and for how long can we dictate prices before a viable used book market undermines our asking price?” are questions that publishers must always ask when creating works. Second item is the “Law of Diminishing Returns” in which each extra book produced comes with the built in risk that it will not pay for its own production cost, simply waiting around to be sold at a loss.

E-books remove both these concerns immediately by doing away with a used market and by also guaranteeing that only as many copies as are needed are produced. The effect from the Law of Diminishing Returns is mitigated while simultaneously the threat of lost revenue posed by a secondary grey market -in the form of used book sales- is obliterated. Both of these items make $9.99 and under not only viable but also profitable, because they serve to lower a publishers cost of production. By paying more than $9.99 ebook readers are merely subsidizing publishers’ chaotic and failing traditional book hierarchy, which is inherently unfair to ask and downright immoral to implement.

The problem is that producers of content in the 21st century suffer from what is known as the “Innovator’s Dilemma” in which they refuse to restructure due to the short term potential for massive losses that such restructuring entails. Inversely, consumers sensing that the products being sold are over-priced simply begin to steal the products. End result, old-media collapses while explicitly ignoring the potential for its safe passage into the digital era. Bezos and other 21st century technology gurus will seek to create refuges –derisively known as walled gardens- for old media in a wise bid to profit from their bleak situation.

In this arrangement consumers are rewarded by being given access to quality materials usually at reasonable prices but suffer due to a genuine lack of portability due to crippling DRM. The assumption that these microcosms are inherently unstable is foolish conjecture in that it explicitly ignores the stark reality that consumers will otherwise hold too much power resulting in the electronic version of overgrazing. In which too many consumers exceed a given piece of land’s carrying ability.

By creating a stable price range consumers tendency to over consume is effectively controlled while encouraging higher price points from producers: preventing a “race to the bottom” in which producers out compete one another on price thus driving down prices to the point of starvation. If I were a media producer, I would hopefully realize that perhaps the only way to survive is to join these stable ecosystems without delay. For everyday that they waste is another day closer to their day of financial judgment.

Very well said Alejandro. I am with you almost all the way on what you say.

I would suggest that it is a ‘perception’ of such losses that it driving their actions. A perception suffered because they have not been watching the Music industry experience properly and they have been keeping their head in the sand in the build up to the arrival of the kindle and iPad. This seems to have nobbled their vision and ability to see the potential that the eBook market has to expand book reading and book sales far beyond what it has ever been before.

Where you lose me, and get decidedly dodgy, is in the last two paragraphs where you talk about quality product at reasonable prices. I suggest that over the period of the last year we have seen the appalling situation where many hit titles have been priced higher for the eBook than the paper book. This is not reasonable – though there are signs of it improving.

I also find the very concept of what you call “over grazing” and the” race to the bottom”, nonsensical and almost comical. The implication is that a free market in eBook pricing will produce a ‘race to the bottom’ where prices plummet and producers lose money ? Are you seriously suggesting that ? what other market has demonstrated this ?

You are suggesting that an ordered system of price control is good for all concerned ????

Very well said Alejandro. I am with you almost all the way on what you say.

I would suggest that it is a ‘perception’ of such losses that it driving their actions. A perception suffered because they have not been watching the Music industry experience properly and they have been keeping their head in the sand in the build up to the arrival of the kindle and iPad. This seems to have nobbled their vision and ability to see the potential that the eBook market has to expand book reading and book sales far beyond what it has ever been before.

Where you lose me, and get decidedly dodgy, is in the last two paragraphs where you talk about quality product at reasonable prices. I suggest that over the period of the last year we have seen the appalling situation where many hit titles have been priced higher for the eBook than the paper book. This is not reasonable – though there are signs of it improving.

I also find the very concept of what you call “over grazing” and the” race to the bottom”, nonsensical and almost comical. The implication is that a free market in eBook pricing will produce a ‘race to the bottom’ where prices plummet and producers lose money ? Are you seriously suggesting that ? what other market has demonstrated this ?

You are suggesting that an ordered system of price control is good for all concerned ????

Unfortunately I think the publishers are thinking more along the lines of: “$10 ebook = profits of $26 hardcover? great! lets sell it for $20 and bump that up to $52.”

The real treat is that they will probably end up selling far less ebooks and use piracy as a scapegoat for why.

In a nutshell you have said it.

There is no overgrazing with digital media. Overgrazing happens in commons when the cost of the supply is shared by all consumers and incremental consumption costs are almost zero. Then each individual consumer profits from consuming more, but the whole thing collapses when the total consumption is more than the supply. In digital media the supply is potentially infinite so no overgrazing.

All the protective measures of the suppliers are built upon the old scarcity model and therefore they don’t work in the new model. And because they fail to be adequate, they just don’t solve problems but make them worse.

Amazon’s closed microcosm works as long as it has a significant share of the market, but as soon as they have real competition customers will want to get loose of their grip.

What exactly is meant by ‘overgrazing’ in this context?

Hello! Thanks for sharing your thoughts. I believe that publishers will try to shoot themselves in the foot. They will charge exceedingly higher prices and then blame piracy for lost profits. I also believe that e-book markets can support only a preset amount of companies or individuals at certain low price points: such as .99. If too many individuals try to match the artificially low price point, consumers will then frequent the lower price sellers thus pushing further downwards. This is how consumers can “overgraze” by driving prices downward through their actions to the point of market collapse. Producers have to hold a priceline somewhere, it seems that the sweet spot for all is 2.99 to 9.99. Anything under and it’s a race to the bottom; anything over it’s price gouging. I hope this somewhat legible being that I am responding via my phone.

We may also be discussing two different products; the book reading delivered to the screen and the book possession delivered in print. Publishers can sell both these products for a single title and they can sell both to the same and to different buyers. The only reservation would be cross sales cannibalization or inability to sell screen and print at the same time and such trends have not emerged as risk for the overall dual product approach.

Alejandro I appreciate your attempt to explain . However I am afraid that it appears to me that your grasp of business is somewhat flawed. A price war between competitors is a periodic characteristic of any competitive market, and it happens from time to time. Your mistake is in suggesting that it leads to some kind of market collapse. It does not. If prices drop below cost then competitors start to lose money and the one with the shallowest pockets goes out of business, leaving the rest behind.

The sole situation where your suggestion would be damaging to the customer would be a price war between two dominant competitors. if one goes but the other gets to fix prices. However as long as there is a range of competitors then this whole scenario is mute.

Competitors have to make a profit to survive. The winners of the market place are the ones who manage to stay alive by making profits while charging the lowest cost, where cost is the controlling factor in that market. That is good for the reader and the consumer.

It is not for anyone to dictate prices. The Publishers/Agents chose their wholesale price and eBooks must be supplied to all resellers in an open market. It is for the reseller – the retailer – to chose a price for themselves. This is how it will and must play out once the monopolies are broken.

When discussing the $9.99 price point, are we talking about just newer books, or are we also including older, backlist titles?

I went to Kindle store the other day. I was thinking about buying ebook versions of the ancient tattered Ian Fleming/James Bond paperbacks I’ve owned forever.

I was appalled to find the price set at $9.99 each! That’s $9.99 for an ebook version of a work by a deceased author that has been out in paperback for 50 years. That is insane. It’s more than new paperbacks cost. Who would pay that?

I would scan my old paperbacks, OCR them, and make my own ebook versions (just for my own use, mind you) before I would spend that much money on ebooks of older backtitle works.

And that’s the whole point. The major publishers haven’t learned anything from the music industry. If they settle on a reasonable price point, people are willing to pay a fair amount for ebooks and will continue to buy them legitimately. However, if they price gouge, people will find ways to get those ebooks anyway–for free–and the big publishers will be forced to change the way they do things, or fail.

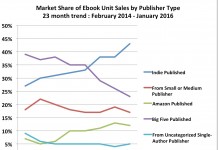

Many more authors will choose to self-publish — go indie, as many musicians are doing — or work with small, independent publishers, who will do very well. The big publishers, however, will have a very tough time of it if they don’t start paying attention.